Review of the year 2019

How do you write an interesting annual review when you can’t think of anything big that has happened in the previous year?! I have to admit to a dread hanging over me as I recovered from the excesses of Christmas and started to think about what to write. No new deals to talk about and what had really changed in the last year? My Imposter Syndrome was working overdrive…

Like most owners, we view the development of our businesses as a long-term effort and so defining progress based on the time it takes Earth to revolve around the Sun doesn’t seem all that relevant! As it happens, financially, 2019 was a very good year for all our companies but in order to step back and think about what we had really achieved I mapped the impact that Nevis has had on its businesses to date.

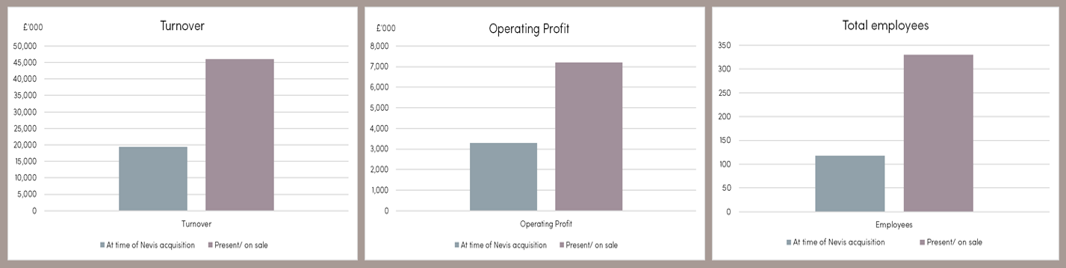

Across the companies that we have owned, the collective results are shown below:

We’re proud to have nearly trebled the workforce in these businesses and whilst the financial results are satisfying, we know there is a long way to go and that each business can do substantially more.

Reflecting on what is behind the figures, we know they don’t tell the full story and we take greater pride in the unmeasurable things that we have achieved and that we think will continue to bring success to the businesses in the future.

There is always a need to consider your strategy and assess opportunities specific to individual businesses (new products or markets for example) but in smaller businesses we would tend to agree with Brent Beshore:

“The best course forward is typically neither complicated, nor difficult to determine. What’s hard about strategy is execution and culture and systems-building and incentives and leadership. Companies most often languish for lack of execution, not poor strategy.”

That is why we don’t see our role with our companies as “governance” or turning up for a monthly board meeting. We work closely with the management team to agree a clear vision of where the business is going and then spend our time ensuring we execute on that. That can be recruiting new talent or developing existing teams; increasing capacity or embracing technology. Importantly, we can help to make sure that the management teams don’t get bogged down in the day to day and forget about doing the things that will make a difference to the year to year.

Portfolio Round Up

So how have our companies executed in 2019?

Dieselec Thistle rebranded as DTGen to better reflect our move away from supplying solely diesel generators and into prime and standby gas generators as well. We collaborated again with our friends at Tangent and are delighted with the results which highlight the critical impact our products have upon the sectors in which we work. We also made good progress within the business: simplifying and improving our organisational structure, agreeing new partnerships, securing the first sales of our gas generator product (we discussed these last year) and significantly invested in our presence in the English market.

At Astec Precision, Craig Hyslop and the team have continued their journey. In the two years since Craig joined as Managing Director, turnover has increased more than 60% and we have doubled the number of employees to position us for further growth. Even more importantly, the team has improved both quality and on-time delivery and experience tells us that this is the key to keeping customers and winning new ones. We’re laying foundations for what we believe can be a much bigger business and the next stage in our development is a significant increase in capacity. Finding the right solution to that is a key goal for us in 2020.

Merkland Tank is the newest member of our portfolio and last year I described how Robert Gibson and his team had worked hard to get operations ready to scale. I’m pleased to say that this year has been about putting these operations to the test! They’ve passed with flying colours, having successfully targeted new customers and geographies to grow sales and profits by 30%. We think there is a great market opportunity and, having come close on a couple of bolt-on acquisitions, plenty of room for further organic and acquisitive growth in the future.

Lastly, 2019 was the 99th year of trading for James Ramsay, our industrial and commercial heating and pipework specialists. For the last 6 years we have worked with Raymond Shepherd and his team to develop the business and in February 2018, we created a new detailed plan of what was required across Sales, Operations, Finance, People and Strategy. That included a new system, new people, standardising processes and procedures, developing our senior leadership and, as we discussed last year, focusing on its specialist skills and customers who value them. I’m pleased to say that as a team we’ve delivered on the vast majority of that plan and 2019 bore fruit with profits more than double the highest previously achieved. Even more pleasing for us was seeing Gary and Jamie Shepherd (Raymond’s two sons) come through as Directors and Shareholders in the business. They have been instrumental in the success of the business and their promotions are well deserved. We have an excellent team working with the Shepherds and, with a focus on continually improving, we think our 100th year could be the best yet.

New Deals

So why didn’t we do any new deals in 2019? We’re not private equity so it’s not all about spending money. We are focused on finding the best way for us to create equity value for us and our fellow shareholders over the long term and that means that sometimes our time and investment will be best spent on the current portfolio and other times on new deals.

“The big money is not in the buying and selling, but in the waiting… It’s waiting that helps you as an investor and a lot of people just can’t stand to wait” Charlie Munger

We’re still seeing lots of opportunities (more than 120 in 2019) but we set ourselves a high bar and we know there is great value in declining the wrong ones. This year, we’ve also seen a trend for deals not completing due to unrealistic Seller price expectations. This is a trend that seems to have been reasonably widespread as shown in the most recent research from the International Business Brokers Association:

*Main Street refers to businesses with EBITDA < $2m

So, what is a realistic price expectation? We’re not aware of any detailed UK wide data for businesses in our target market, but were interested to see the following table presented to us by some sell-side advisors:

The table shows what you might expect – that the multiple increases with profits as larger businesses tend be more robust, diverse and possess more complete management teams. In general, this can help reduce risk and therefore increase price.

There will always be outliers, businesses with exceptional management teams or growth opportunities that render current profitability a meaningless guide to future profitability, but for most others we think this is a reasonable reference point and it ties pretty well with our own experience over the last 20 years in the deals market.

Nevis Explorers

As in most years, I’m going to finish with a shameless pitch asking you all to help us find our next deal. We’ve been fortunate that many of you have already linked us with opportunities in the past but we’d like to give you some further incentive to get your thinking caps on…

In 2020, we’re launching the new Nevis Explorers scheme (just email us at explorer@neviscapital.co.uk and we’ll register you for the programme). That means that if your introduction leads to Nevis acquiring a new business (and in addition to whatever work you or your firm are paid for as part of the transaction), you’ll receive £20,000 and a £5,000 holiday voucher. While we’re exploring our new business, you can be off exploring wherever you want! Proof that it really does pay to think of others! ?

As a reminder, we’re looking to acquire some or all of private businesses with at least some of the following criteria:

A consistent track record of between £500,000 and £1,500,000 of annual profit

A high level of repeat customers

Long serving employees

Some retainable management

Some business owners want to sell to trade; some are enthused by the idea of private equity and its drive for immediate and significant growth. Others, we know, are looking to sell their business to people who will continue its steady development, protect their people and brand and aim for long term, sustainable success. These are the ones we’d like to meet.